The shift in power in Washington has, not surprisingly, prompted a good deal of prognostication from those who make their living prognosticating. Thankfully, we are free instead to focus on prudent investing.

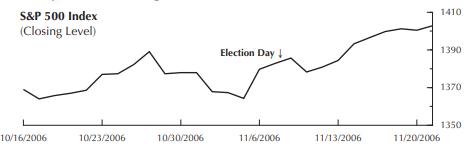

It is interesting to note that up until the votes were counted, no one was really sure how Congress might be altered. Nevertheless, when it became clear that the Democrats had won control of both houses, the market barely reacted. As the chart below demonstrates, the market had apparently “priced in” the Democrats’ strong chances well before Election Day.

The lesson for investors, once again, is that the stock market is a forward-looking mechanism for discounting information. It is prudent to simply ride

out events rather than try to out-smart the market by adjusting your portfolio in

anticipation of what might occur.

Investors are, however, directly affected by tax policy. You can and should stay apprised of new laws and take action to ensure maximum after-tax returns. In coming months we will keep you informed of pertinent changes as the priorities of the new Congress become clear. In the enclosed article we address several current tax-related matters many individual investors will find important.

Index Mania

Part of our job is to keep you informed regarding new investment vehicles that might prove worthwhile. This month we assess a new breed of index-based products. We recall that not long ago conventional wisdom held that index investing and dividend-paying stocks were for chumps. Now, six years after the great tech-stock melt down, both have proven their worth. So, naturally, indexing and dividend-based approaches are all the rage; money managers suddenly find they cannot create new products fast enough. Several have put their own unique twist on traditional indexing in order to tout what they claim is a previously undiscovered approach; some go so far as to suggest that a revolution in indexing is at hand.

Though their work is backed by empirical research, the data thus far has left us unconvinced. Call us cynical, but in our estimation this self-styled new school of indexing hardly amounts to a revolution. To the contrary, it reflects an age-old concept familiar to students of business everywhere: a product that is differentiated in the mind of consumers can command a higher fee.

Also in This Issue:

Fundamental Indexing: New and Improved or New Packaging?

Tax Matters: ‘Tis The Season To Be Careful

The High-Yield Dow Investment Strategy

Recent Market Statistics

The Dow-Jones Industrials Ranked by Yield

Asset Class Investment Vehicles

To access the full article, please login or subscribe below.

Already a Subscriber?

Log in now

Subscribe Today

Get full access to the Investment Guide Monthly.

Print + Digital Subscription – $59/YearIncludes 12 Print and Digital Issues

Print + Digital Subscription – $108/2 Years

Includes 24 Print and Digital Issues

Digital Subscription – $49/Year

Includes 12 Issues

Digital Subscription – $98/2 Years

Includes 24 Issues