On March 26 Federal Reserve Chairman Ben Bernanke reaffirmed the Fed’s desire to hold interest rates low for the foreseeable future. With current annual price inflation (CPI) running close to 3.0 percent and 90-day Treasury bills yielding 0.10 percent, it appears investors will continue to confront negative real returns on cash equivalent assets for some time.

The Fed, saddled with an implausible dual mandate of maximum employment and price stability, has clearly chosen to pursue the former at the expense of investors who rely on Treasury bills, CDs and money market accounts to fund their day-to-day spending needs. According to a recent New York Times article, Sarah Bloom Raskin, who serves on the Fed’s board of governors, claimed during a recent speech that less than seven percent of household assets were held in short term instruments, and that “Instead, the bulk of household wealth is held in stocks, retirement accounts, business equity and real estate” and that “For these other types of assets, rates of return depend primarily on the strength of the economy and how fast the economy is growing. Thus, these returns should be supported, over time, by the accommodative monetary policy that we have in place.”

Fed-speak translation: “Don’t worry, buy stocks.” Apparently it is of little concern to Ms. Raskin that stocks, business equity and real estate are far riskier than cash equivalents. While it is true that these assets provide returns that outpace rising consumer prices over time, they are highly volatile and therefore do not serve well in the short term as a hedge against price inflation. The Fed’s expansionary monetary policy comes at the expense of savers, who are being encouraged to assume the far more speculative role of equity investors.

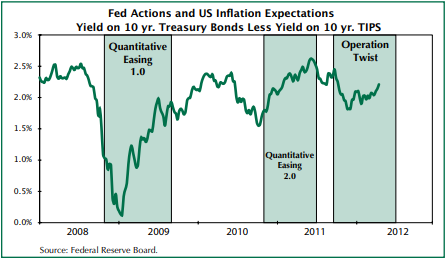

Our concerns run deeper. The Fed’s several attempts toward quantitative easing have significantly increased the probability of accelerated price inflation (see chart on following page). Indeed, AIER’s research shows that 15 percent annual price inflation (CPI) is not inconceivable by early 2014, given current monetary aggregates, and depending on changes in the money multiplier and future Fed policy. The predicament investors now face, as bad as it is, could quickly become a disaster.

The problem is compounded when consumer inflation is examined more closely. As we recounted last month AIER’s Everyday Price Index (EPI) makes clear that prices of goods and services that households purchase frequently are far more volatile and have risen a great deal more than the CPI.

Fed policies have left investors with a serious dilemma: accept negative real returns on cash equivalent assets, or take a chance by tilting more heavily

toward stocks. The asset classes we recommend include carefully established commitments to U.S. and foreign stock and commercial real estate. Gold is included as insurance against extreme and sudden bouts of price inflation as well as financial crises. But these volatile holdings are balanced with short term bonds and TIPS, which are intended to provide a hedge against short term price inflation.

Your best defense remains a portfolio allocated across these assets according to your needs and tolerance for risk. Do not reach for yield by overweighting high yielding stocks or below-investment-grade bonds. Investors most vulnerable to short term price shocks, such as senior citizens who rely on their savings for cash flow, should favor short term bonds and TIPS within their fixed income allocation.

Also in This Issue:

Structured Asset Management: Walking the Walk, Part 1

Momentum in Stock Prices: Avoid Falling Knives

A Reader Inquires

The High-Yield Dow Investment Strategy

Recent Market Statistics

The Dow-Jones Industrials Ranked by Yield

Asset Class Investment Vehicles

To access the full article, please login or subscribe below.

Already a Subscriber?

Log in now

Subscribe Today

Get full access to the Investment Guide Monthly.

Print + Digital Subscription – $59/YearIncludes 12 Print and Digital Issues

Print + Digital Subscription – $108/2 Years

Includes 24 Print and Digital Issues

Digital Subscription – $49/Year

Includes 12 Issues

Digital Subscription – $98/2 Years

Includes 24 Issues